Appearance

Taxes

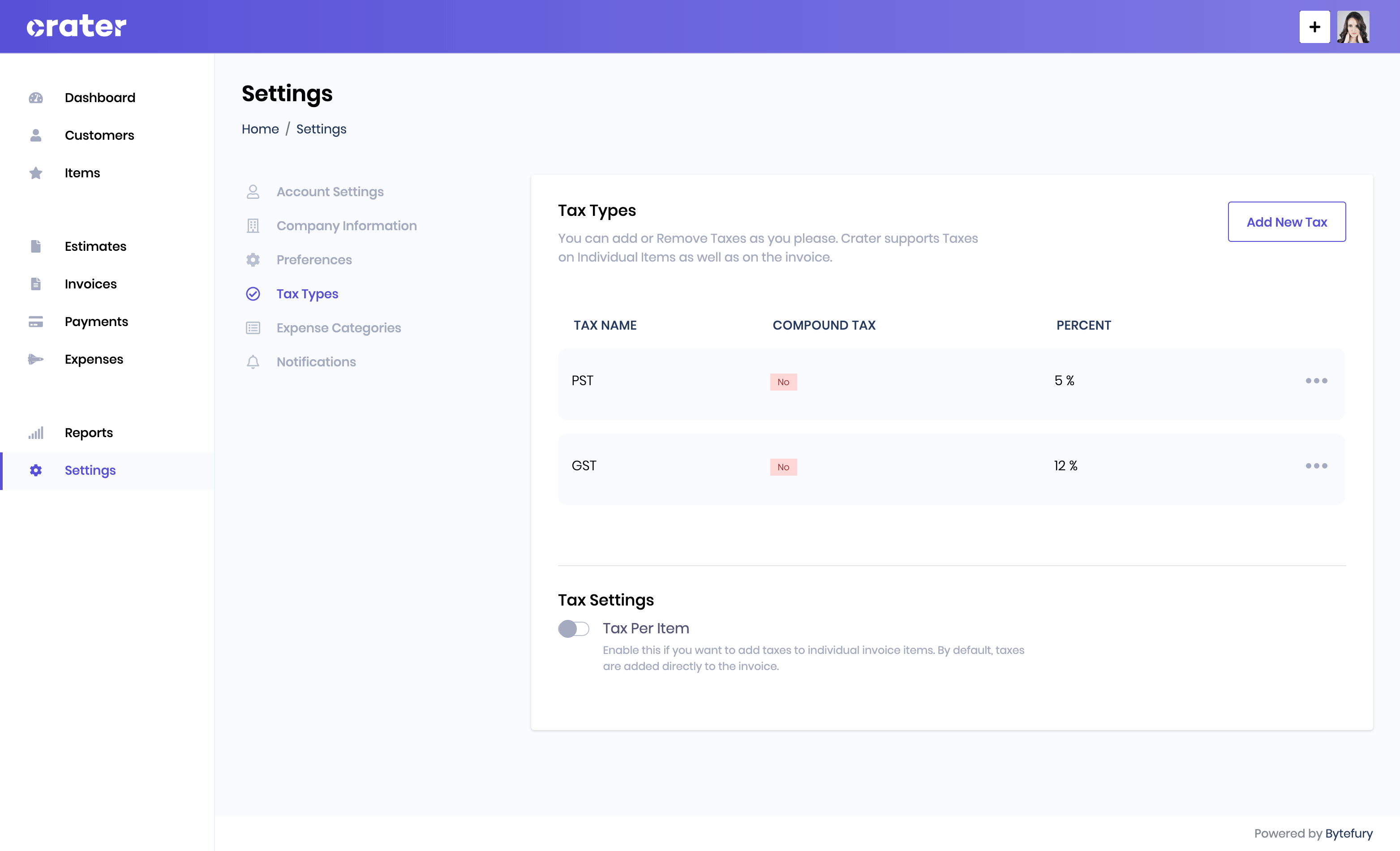

InvoiceShelf makes it really easy to manage taxes. You can add multiple taxes on Total Invoice Amount or on Per-Item basis.

To get started with taxes, you just need to add a new Tax Type with name of Tax & Percentage on the Settings -> Tax Types page. After adding a Tax Type, you can apply the newly added tax to an Invoice.

Tax Per-Item vs Tax on Total Invoice Amount

By default, Taxes are added on Total Invoice Amount. But you can update that setting anytime on Settings -> Tax Types page by clicking on the Tax Per Item toggle button.

Also, Note that Tax Per Item setting does not affect Invoices that have already been created.

What is a Tax Type?

Tax Types basically define the Percentage of tax that can be applied to an Invoice or Estimate. You can add or remove Tax Types from Settings -> Tax Types page.

Note that you cannot remove a Tax Type which has already been applied to an invoice or estimate.

Tax Type Fields:

- Name: Name of the Tax (for example: GST , VAT or PST)

- Percentage: Percentage of tax to be applied.

- Description(optional): Percentage of tax to be applied.

- Compound Tax: Specifies whether a tax is a Compound Tax or not.

What is a Compound Tax?

A Compound Tax, also known as a Stacked Tax, is a tax that is calculated on top of one or more Simple taxes.

You can select whether a Tax is supposed to be calculated as Simple tax or Compound tax when adding a new Tax Type on InvoiceShelf.

Example:

| Item Price | $ 100 |

|---|---|

| GST (10%) | $ 10 |

| Subtotal | $ 110 |

| PST (5%) | $ 5.5 |

| Total | $ 115.5 |